Personal Financial Planning

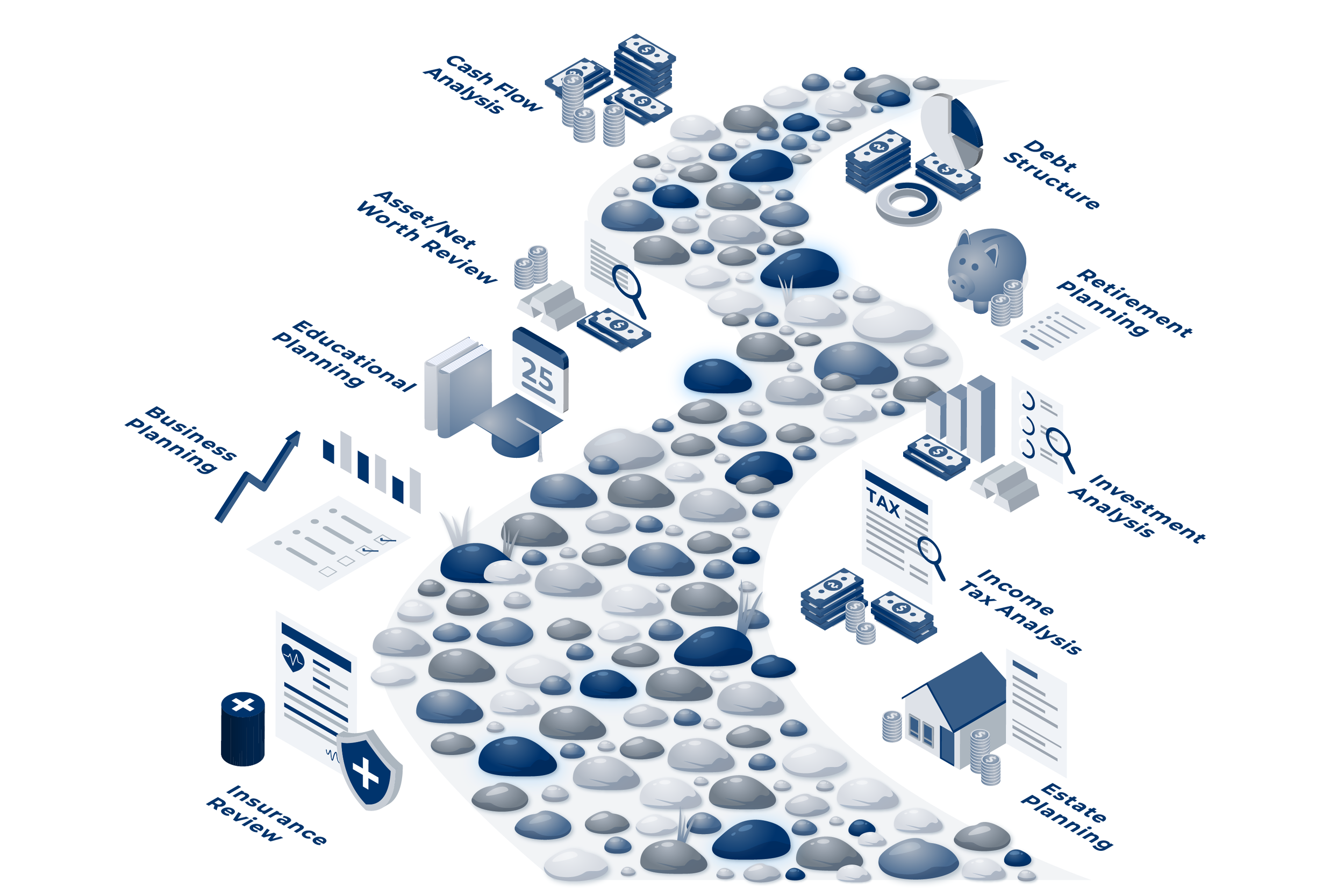

At PFM, we have the expertise to formulate a comprehensive financial plan to achieve your financial goals. A quality financial plan integrates the disciplines of financial planning, including retirement forecasting, tax planning, educational funding, cash flow planning, investment allocation analysis, etc. Our comprehensive approach assures that advice with regard to one aspect of your plan does not conflict with other considerations.

Based upon your specific needs, a comprehensive planning session at PFM typically addresses the applicable issues:

Cash flow planning

Estate & gift tax planning

Education planning

Stock Option planning

Retirement forecasting

Income tax planning

Pension planning

Investment strategy

Risk management insurance and asset protection

Business succession planning

The journey to financial independence begins with an initial interview to review your financial information and set the expectations for the financial planning session.

During the personal financial planning session, we establish your financial goals then outline your critical path with recommendations tailored to your specific circumstance.

After the planning stage, PFM assists our clients with the implementation of the customized recommendations. The identification and implementation of the clients’ critical path solutions is the key to your financial success. Our comprehensive approach assures that advice with regard to one aspect of your plan works cohesively with other considerations.